What UK Businesses Want in Hunt’s Budget: Investment, Tax Cuts, Skills

Table of Contents

The UK business community is urging Chancellor of the Exchequer Jeremy Hunt to incentivize investment, cut taxes and tackle skills shortages in his budget next month, after the British economy narrowly avoided a recession last year.

Article content

(Bloomberg) — The UK business community is urging Chancellor of the Exchequer Jeremy Hunt to incentivize investment, cut taxes and tackle skills shortages in his budget next month, after the British economy narrowly avoided a recession last year.

Advertisement 2

Article content

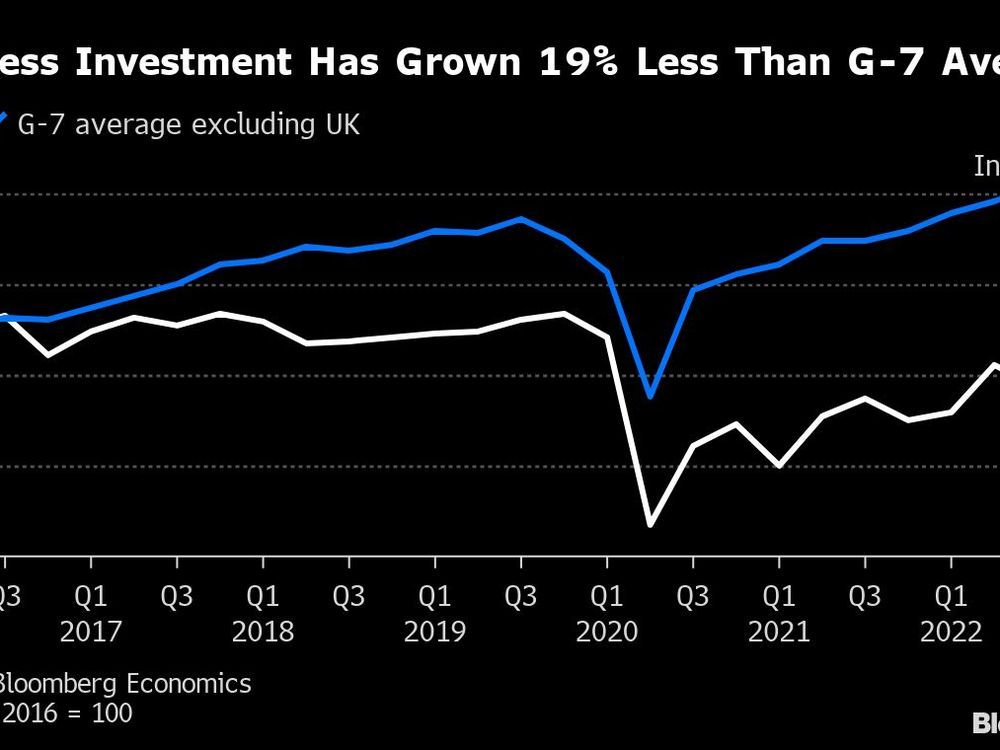

Hunt, who will deliver his second major fiscal statement on March 15, has warned he has limited room for giveaways and his priority is to bear down on inflation. He’s also seeking to boost economic growth, with the UK economy still 0.8% smaller than it was at the end of 2019, the only Group of Seven country yet to fully recover output lost during the pandemic. But businesses say they need a clearer signal to invest.

Article content

“Everywhere they turn, businesses see barriers to investment and expansion,” said Shevaun Haviland, director-general of the British Chambers of Commerce. She cited issues such as poor provision of childcare contributing to labor inactivity, high energy costs, excessive business taxes and a lack of green funding. “We urgently need to see coherent policies from government that set the economy on a path to growth.”

Advertisement 3

Article content

Here’s what UK plc is asking for on March 15:

Encourage Investment

Executives want Hunt to go further to boost investment, given that the UK’s flagship corporate tax break — the so-called “super-deduction” giving firms 130% tax relief on capital spending – expires at the end of March.

The Institute of Directors, a lobby group, has told Hunt to maintain the super-deduction. The Confederation of British Industry, the UK’s largest business lobby, says Hunt should let firms deduct 50% of their capital spending from their tax bill, rising to 100% over three years.

“Investment incentives are being pulled away just at the time we need them most,” said CBI Director-General Tony Danker, pointing also to a scheduled increase in corporation tax to 25% from 19% from April. “It will have a huge impact on investment and leave the UK falling behind its global competitors.”

Advertisement 4

Article content

Fix Labor Shortages

Hunt is concerned by high levels of labor inactivity in the UK, an issue that has exacerbated skills shortages, holding back growth.

The Federation of Small Businesses said improving childcare provision will boost labor market participation by freeing up employees to work, and has called for Hunt to increase the maximum amount claimable for tax-free childcare to £3,000 ($3,600) from £2,000. It also called for day nurseries to be exempted from business rates, a tax on bricks-and-mortar premises.

MakeUK, which represents UK manufacturing, said Hunt should review restrictions on immigration to fill critical labor gaps. The IoD said Hunt should give tax credits to firms that invest in training staff in areas of national need.

Advertisement 5

Article content

Cut Business Taxes

The FSB wants Hunt to ease the tax burden on small firms by lifting thresholds for business rates. The tax is unpopular among company owners because it’s charged regardless of whether a business makes a profit and applies specifically to firms with a physical presence on Britain’s high streets.

“Business rates remain a significant barrier to small business growth, confidence, and investment,” the FSB wrote in its submission to Hunt. Raising the threshold “would be the single greatest contribution to levelling up,” it said, referencing the Conservative Party’s pledge to spread wealth around the UK.

MakeUK Chief Executive Officer Stephen Phipson agreed, saying Hunt should also re-examine the use of payroll taxes.

Advertisement 6

Article content

“That’s where the problem and burden is,” Phipson said in an interview. “It’s about pre-profit taxes.”

Bolster the Green Economy

Hunt is facing various calls to include eco-friendly measures in his budget. MakeUK said he should extend the super-deduction tax break to green plant and machinery, to help firms cut their carbon emissions and also boost investment.

The FSB said Hunt should give small firms a £5,000 ‘Help to Green’ voucher, to invest in improvements such as heat pumps, better insulation or solar panels. Hunt should also consider offering a lower corporation tax rate to companies that achieve net zero carbon emissions, the IoD said.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation