Authorized Tech Startup Backed by Large Legislation Fights to Be Income Good

Reynen Courtroom Inc., a lawful technological innovation system backed by Huge Regulation companies, is shedding charges immediately after the business said it underestimated the obstacle of finding shoppers to buy and use the merchandise.

The Amsterdam-based mostly organization is eradicating physical workplaces, slicing journey and working with fewer applications soon after slashing headcount “pretty dramatically” from its peak of 34, CEO Andrew Klein explained in an job interview. He declined to be unique on occupation reductions.

The business that delivers merchandise as a result of its 160-vendor system is also weighing regardless of whether to elevate prices on its “most engaged” customers—all aspect of an work to have a lot more money transfer in than out, he said.

“We need to have to be hard cash-movement optimistic in the future interval, or close to it expenditures are not able to outweigh revenues,” Klein claimed. “Are we 100 per cent confident that we can get to money-stream good? We aren’t—but we remain optimistic.”

Reynen Court’s fight for survival underscores the challenge of persuading Big Legislation corporations to adopt new technologies, notably when uncertainty about a recession has lawful operations trimming work opportunities and shell out.

Legislation companies backing the enterprise, which has elevated $19 million given that its 2018 start, involve Latham & Watkins Clifford Probability Orrick Paul, Weiss, Rifkind, Wharton & Garrison and the Japanese organization Nishimura & Asahi. Latham and Clifford Likelihood each invested $2.1 million in 2018, Klein mentioned.

Klein himself has invested at the very least $2.8 million by way of Prins H LLC, a automobile he controls.

Reynen Courtroom has 30 legislation company shoppers though had predicted about 200 by now, Klein reported. It’s “fair to say we tried out to do also lots of points as well early,” he said.

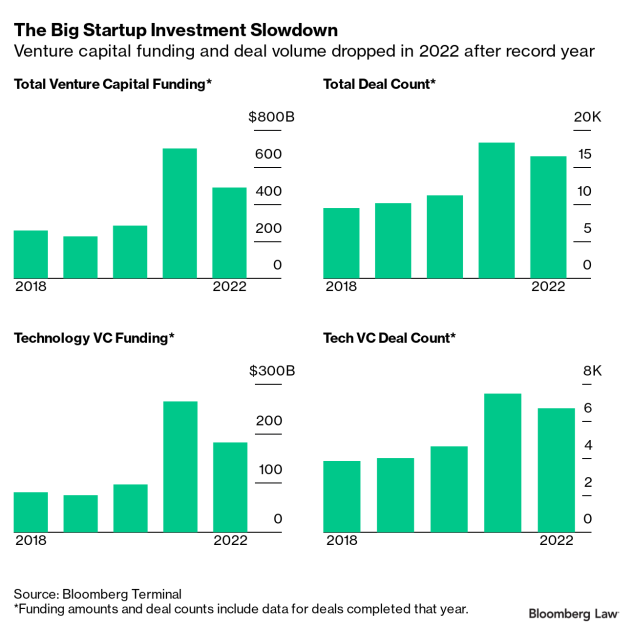

Further fundraising, both from enterprise capital operations or from regulation firms, is on hold for now. Avenues for fundraising have lowered, in element for the reason that of the major drop in undertaking capital funding for tech startups as a result of late 2022.

“Our significant emphasis is on execution, not on fundraising,” Klein mentioned. “Will we be profitable? We will not know for nine to twelve months.”

Difficult Situations

Periods have been hard in lawful tech due to the fact of a deficiency of trader funding and regulation corporations being hesitant to make prolonged-phrase commitments, claimed Dan Jansen, CEO and controlling director of Nextlaw Ventures, a lawful tech undertaking cash procedure shaped by Dentons.

But Jansen said he’s optimistic about Reynen Court’s business enterprise model. Vetting authorized tech distributors is a “real value” for firms making an attempt to ascertain which solutions address a want and will be used by attorneys, he claimed.

The legal current market has benefited from Reynen Court’s services, which have integrated assisting corporations migrating to the cloud, reported Toby Brown, CEO of the consultancy DV8 Legal Strategies.

But he said law corporations at situations have also experienced problems comprehending how they might profit from providers. “I was in no way certain I understood the benefit proposition of what Reynen Court docket was supplying,” stated Brown, previous chief exercise management officer for Perkins Coie.

When Reynen Court docket was introduced in 2018, a dozen prestigious legislation corporations in The usa and Britain and other backers of the self-described application shop for legal technologies claimed they experienced large hopes for the challenge.

Klein, a previous Cravath, Swaine & Moore affiliate, stated there nevertheless are fascinating things taking place with the system. The 160 sellers is up from 140 in 2021.

Reynen Court will gain from a new partnership with a business to help clientele manage their cloud platforms, he said. Another partnership will supply 24-hour company and buyer assist, Klein claimed.

The identities of the husband or wife providers will be announced in the coming months, he stated.

The business “certainly is not lifeless and buried,” Klein reported of Reynen Court. He acknowledged it has far more operate to do to become income-move positive.

“I don’t consider any individual has an appetite to pour revenue into a company that’s been dropping dollars, quarter about quarter, the way we have,” Klein mentioned. “And that incorporates me.”

:max_bytes(150000):strip_icc()/Law-of-Diminishing-Marginal-Utility-7334854b88ad474bbb7e97ae928eac88.jpg)