Tax period: Extra frequent, convincing frauds on the rise

Do not click on that hyperlink!

The increase of on the internet tax cons has just one specialist worried as tax time techniques and on the web scammers pump out eerily convincing email messages.

“I am anxious for the reason that we haven’t genuinely observed this amount of excellent from the criminals in the past,” cybersecurity pro Chester Wisniewski advised CTVNews.ca in a phone interview on Friday.

Wisniewski claims in the past 10 years, cons pretending to originate from the Canada Revenue Company (CRA) or involving what looks like an official Interac e-Transfer e-mail have grow to be particularly advanced, as the network of criminals building these cons proceeds to grow.

He says international scammers have made it a issue to even abide by Canadian spelling in their email messages to make it much more plausible to Canadians, creating it much more difficult to come across the warning symptoms of a phishing rip-off.

“There’s no for a longer time the telltale symptoms that most people glance for that something’s improper. They you should not look newbie, they you should not have spelling problems or grammatical troubles,” he claimed.

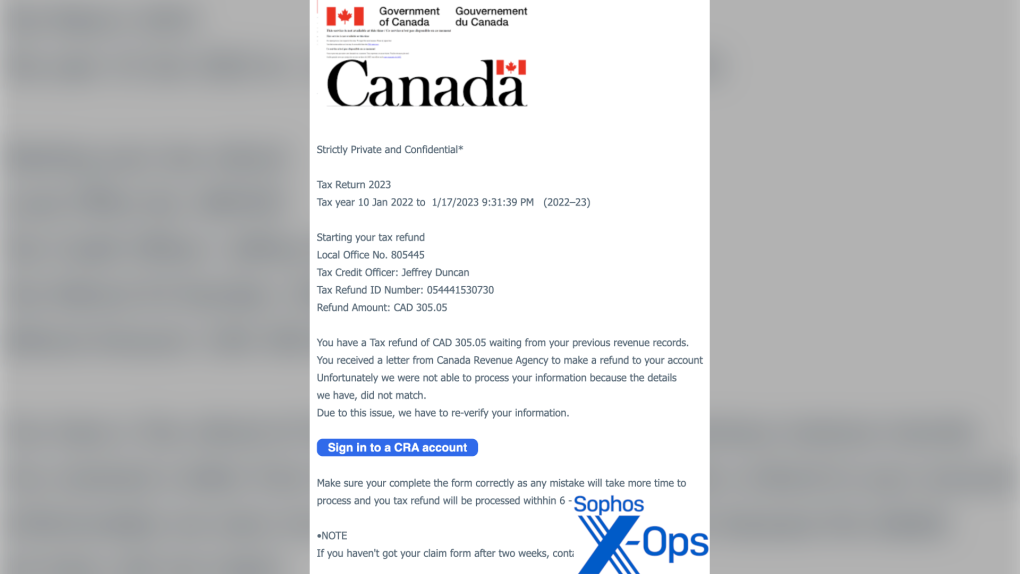

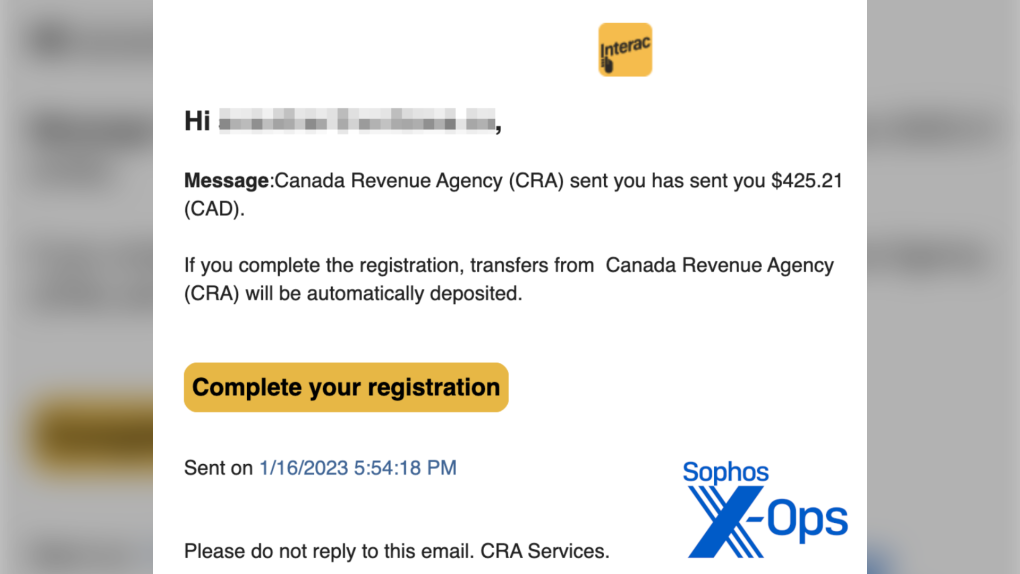

Cybersecurity skilled Chester Wisniewski suggests Canadians need to have to be much more informed of advanced phishing emails getting a lot more significantly convincing and frequent. Picture credit to Sophos X-Ops.

Cybersecurity skilled Chester Wisniewski suggests Canadians need to have to be much more informed of advanced phishing emails getting a lot more significantly convincing and frequent. Picture credit to Sophos X-Ops.

Those people guiding phishing and spear phishing scams either fake to be a generic, identified enterprise or firm, or they act as a qualified organization that an person has existing ties to like the banking institution they use on a daily foundation. In accordance to the Canadian Anti-Fraud Centre (CAFC), 9,000 phishing and spear phishing frauds were described to the CAFC in 2021, amassing $54 million in sufferer losses.

Wisniewski states these scams have evolved from modest groups of criminals to total networks where by criminals can purchase and offer their companies to deliver and make these phony email messages. He clarifies a job in this marketplace could appear like a own remaining hired to generate a bank’s brand and compose the e-mail in the major language of the region currently being targeted. It could also include using the services of a man or woman to lease out a computer system, which is then utilized to send out phishing frauds to the most victims as possible.

“The people today that do just about every job in the legal ecosystem have received very, very excellent at it and that is escalating the results charge of the criminals getting ready to steal more substantial quantities of cash,” he claimed.

Staying Secured, Primarily AMID Corporate HACKS

The CRA specifics on its site it will by no means desire quick payment or send out a backlink with your refund volume on-line, and it will only contact people to notify them of a new information, followed by instructions to go to their CRA portal.

Wisniewski states due to the fact the CRA will only tactic men and women on the net for message notifications, it can be easier to detect fraudulent exercise from scammers pretending to be the CRA. Having said that, he claims, he is involved with e-mails from scammers pretending to be banking institutions or focused enterprises, particularly immediately after latest cybersecurity attacks.

Indigo was a short while ago impacted by a cyberattack that impacted the bookstore chain’s internet site and electronic payment technique. Though it’s nevertheless not known if shopper info was impacted, Wisniewski clarifies similar cyberattacks that achieve access to customers’ particular details could make e mail scams extra plausible.

Cybersecurity expert Chester Wisniewski claims Canadians want to be a lot more informed of complex phishing email messages starting to be far more progressively convincing and recurrent. Picture credit history to Sophos X-Ops.

Cybersecurity expert Chester Wisniewski claims Canadians want to be a lot more informed of complex phishing email messages starting to be far more progressively convincing and recurrent. Picture credit history to Sophos X-Ops.

“We do see them impersonate title makes soon after these major hacks, exactly where they now know all these people have a Marriott Benefits quantity or they know that people have an Indigo account,” he reported.

“As a result, this lends much more credibility to a little something you happen to be employed to interacting with.”

In the end, Canadians need to be on inform for suspicious and unsolicited email messages, texts and cellular phone phone calls as scammers get a head commence on tax season, Wisniewski explained.

He recommends not clicking any hyperlinks for payments you might be not anticipating, or if you are being despatched an e-mail from the CRA, go straight to your CRA account, fairly than clicking any links, to see if the message is in fact reliable.

“I would hope that we will not only continue to see them, we are going to very likely see extra of them, in more frequency, as we get nearer to tax working day,” he explained.

Canadians can file their 2022 taxes starting Feb. 20, 2023 and the deadline for most Canadians is April 30, 2023.